Зарабатывайте кратно больше через стратегии роста, разработанные вместе

с Александром Высоцким

и выйдите в высшую лигу

предпринимателей

Уже 16 лет мы прокачиваем бизнесы

$4 млрд

Оборот клиентов

2300+

Компаний провели через программу акселерации

115+

Экспертиза

в 115+ нишах

Какие вопросы решает x100 Strategy Mastermind с Александром Высоцким:

99,9% владельцев бизнеса зарабатывают на продаже товаров и услуг - бизнес по модели cash cow

- увеличивать продажи,

- нанимать больше людей,

- выстраивать менеджмент,

- пытаться выходить на новые рынки.

- Это постоянная конкурентная борьба, битва за выживание, корректировка бизнес-модели под меняющиеся условия рынка

- Ваш доход как владельца бизнеса от $100к до нескольких $млн в год

- Как правило невысокая стоимость бизнеса, да и владелец особо не задумывается о его продаже. Продает, когда он просто устал и хочет от него избавиться или хочет выйти на пенсию.

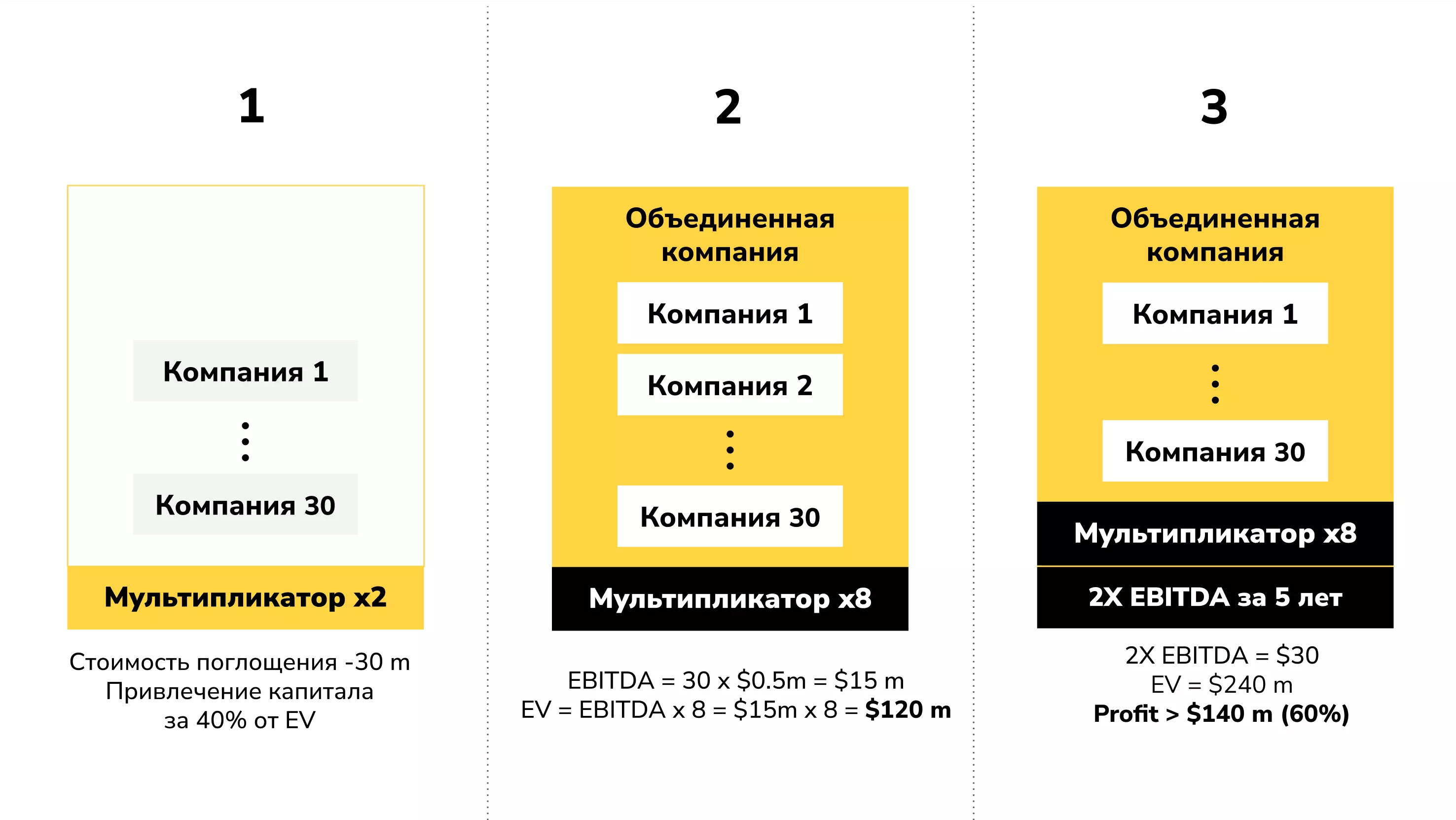

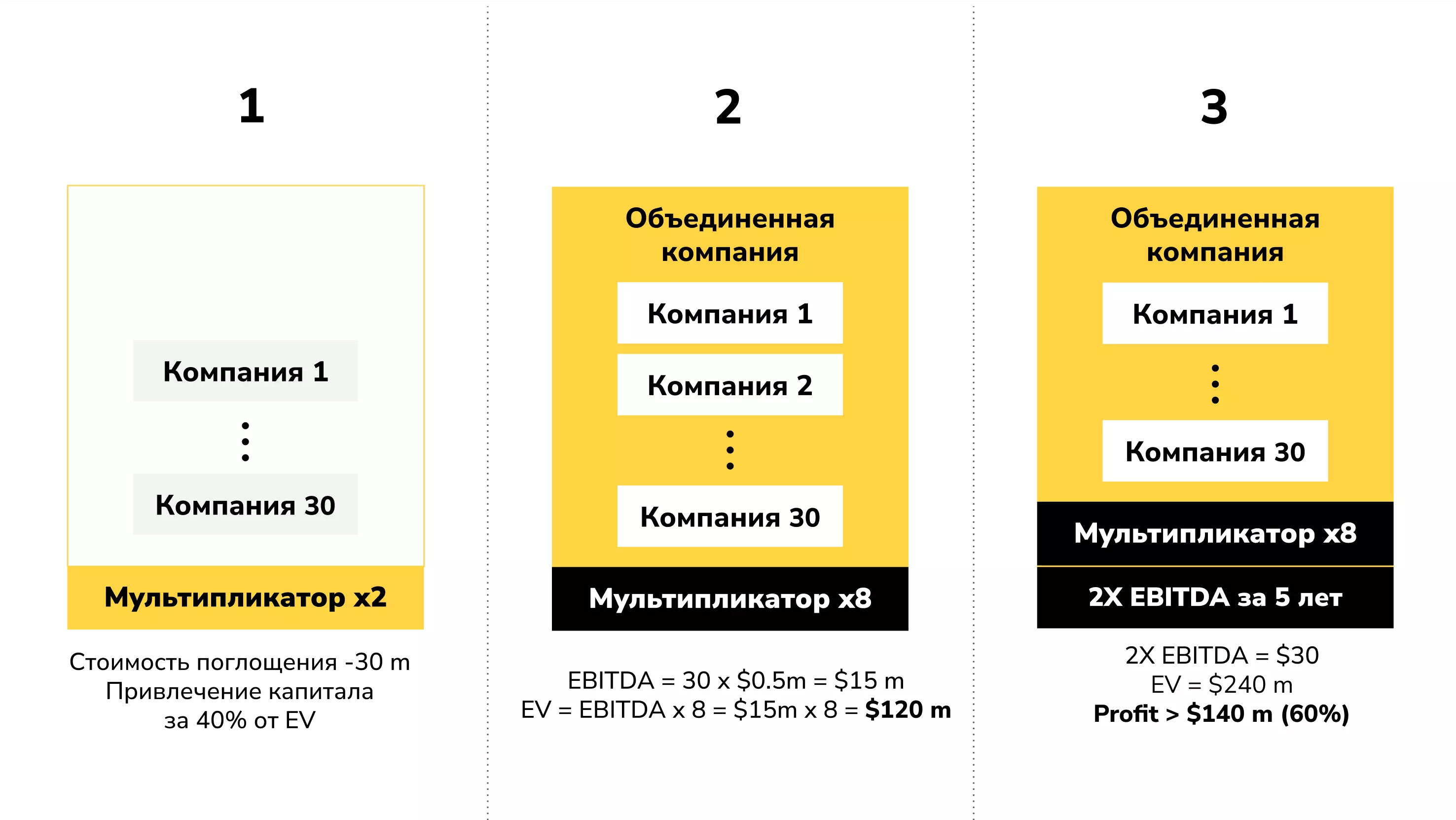

Одна из таких стратегий кратного роста, которая является ключевой в х100 Strategy Mastermind — бизнес по модели Equity

- Относительно короткий цикл - в среднем 3-5 лет от покупки до продажи бизнеса.

- Высокий доход при экзите от нескольких миллионов до сотен миллионов долларов

- Возможность покупки без собственного капитала - есть профессиональные инвесторы, которые готовы финансировать сделки

- Высокий порог входа - нужно разбираться в специфике конкретной индустрии, понимать рынок продажи бизнеса, уметь осуществлять слияния и поглощения, выстраивать управляющие компании и др.

от мультипликатора

Компании из самых разных индустрий реализуют стратегию ролапов

Возможно, вы видели,что в вашей индустрии уже такое происходит, уже замечаете, что кто-то продает/покупает компании. Слышали о крупных сделках в своей индустрии, но не понимаете, как именно это работает.

4 шага к ролапу

с х100 Strategy Mastermind

Mastermind

стратегии

Почему эта стратегия мало

известна среди фаундеров?

Нет открытой информации по роллапам. Это непубличная область, о большинстве сделок нет информации в интернете, как делать ролапы, не набив все шишки - непонятно

Нужны специфические знания:

- как читать финансовую документацию приобретаемых компаний;

- как оценивать компании;

- как правильно делать офер, чтобы договориться о покупке;

- как привлекать инвестиции;

- кому и как продать ролап.

Нужно выстраивать менеджмент в компаниях, объединять их в единую структуру:

- Нужно заменить владельца приобретаемой компании на наемного руководителя без ущерба деятельности, чтобы не разбежалась команда.

- Сделать так, чтобы объединяемые компании работали по единым стандартам с централизацией наиболее экспертных функции.

В х100 Strategy Mastermind есть экспертиза в менеджменте. Мы построили 1000+ платформенных компаний в 115+ нишах

Мы рассмотрели одну из стратегий.

Но путь каждого участника мастермайнда к росту x100 - уникальный

x100 Strategy Mastermind - это среда, где вы находите свою точку максимального рычага.

- Какая из стратегий идеально подходит именно под мою компанию, рынок и личные цели?

- Как адаптировать стратегию под мою реальность, ресурсы и команду?

- Какие есть пути, которые я не вижу?

диалоге с Александром Высоцким, вы создаете свою собственную x100-стратегию. Для кого-то это будет серия покупок и создание холдинга. Для другого — агрессивное масштабирование через филиалы. Для третьего — покупка смежного бизнеса для выхода в новую нишу.

Какие стратегии реализуют резиденты х100 Strategy Mastermind?

x100 Strategy Mastermind —

для тех, кто:

- Является владельцем системного, прибыльного бизнеса (с годовой прибылью от $500k).

Это уже не стартап. Это отлаженная компания, которая работает. Его главный вопрос — не выживание, а кратный рост и масштабирование. - Уже вышел из операционного управления, но не обрел настоящей свободы.

Он делегировал задачи, но не может делегировать видение. Он чувствует, что для следующего шага компании должен измениться в первую очередь он сам. - Понимает, что органический рост на 20-30% в год — это слишком медленно.

Он ищет не способ «делать то же самое, только лучше». Он ищет рычаг, который позволит совершить квантовый скачок и вырасти в 10 раз быстрее рынка.

Одним словом: это люди, которые ищут не «КАК» делать бизнес, а «ЧТО» делать дальше, чтобы выйти на совершенно другой уровень игры. И готовы обсуждать это в кругу равных.

x100 Strategy — единственный проект, в котором можно поработать лично с Александром Высоцким

в Mastermind

Кого мы ищем?

- Кажется, что это слишком сложно.

Due diligence, переговоры, оценка бизнеса — звучит пугающе. В x100 Strategy Mastermind Александр раскладывает весь процесс на понятные шаги. Участники получают полную ясность, что и в какой последовательности нужно делать. - Непонятно, с чего начать и к кому идти.

Даже имея знания, без правильных контактов невозможно сдвинуться с места. В мастермайнде участники получают не только методологию, но и доступ к проверенным специалистам: брокерам, юристам, финансистам, которые помогут реализовать разработанную стратегию. - Нет уверенности, что это сработает.

Теория — это одно, а реальность — другое. В мастермайнде каждый участник получает личную поддержку Александра Высоцкого и видит, как другие резиденты проходят этот путь. Это дает ту самую уверенность, которая необходима для собственных решительных шагов.

Проведем вас по всем стратегиям роста

У нас есть все, что вам нужно для успеха в подходящей стратегии.

как работает механика стратегий роста

и работа с инвесторами

Due diligence

с Александром Высоцким

и легальные аспекты

управляющего офиса

х100 Strategy Mastermind - это ваш личный СОВЕТ ДИРЕКТОРОВ

Формат х100 Strategy Mastermind

с Александром Высоцким

в х100 Strategy Mastermind

База знаний

X100 Strategy Mastermind

-

Оргвопросы

- Советы по прохождению программы

- Как пользоваться платформой

- История создания и цели программы

- План программы

-

Rollup стратегия

- Причины поражений в бизнесе

- Rollup стратегия

- Как работает Private Equity Firm

- Критерии успешной rollup стратегии

- Мотивация владельца

- Практическое задание

- Цифровизация бизнеса: интеграция внешних IT продуктов

- Операционный алгоритм создания rollup

-

Target companies

- Выбор target компаний

- Этапы приобретения target компаний

-

Financing

- Investment memorandum: Executive summary and business description

- Investment memorandum: Market analysis

- Investment memorandum: Management and Organization

- Investment memorandum: Financial projections

- Investment memorandum: Investment proposition

- Investment memorandum: Risks and Mitigation Strategies. Appendices and Supporting Documents

- Привлечение денег для реализации Rollup стратегии

-

Negotiating

- Letter of Intent

-

Due Diligence

- Этапы Due Diligence

- Commercial Due Diligence

- Financial Due Diligence

- Legal Due Diligence

- Проведение Legal Due Diligence при покупке компании в США

-

Tuck-in

- Риски интеграции

- Последовательность действий по интеграции: Выбор типа интеграции. Сбор данных

- Последовательность действий по интеграции: Погружение в компанию. Управление деятельностью

- Последовательность действий по интеграции: Часть 3

-

Управляющая компания

- Зачем нужна управляющая компания

- Функции управляющей компании: Управление проектами. Стратегический маркетинг

- Функции управляющей компании: Организационное построение. Развитие продуктов

- Функции управляющей компании: Автоматизация

- Функции управляющей компании: Управление финансами

- Функции управляющей компании: Юридическое обеспечение. Связи с властью и безопасность

- Функции управляющей компании: PR

- Доли/акции в компании

- Совет Директоров: основные понятия, структура, лучшие практики

В результате участия

в x100 Strategy вы:

- Поймёте, как перейти от линейного развития к экспоненциальному.

Вместо того чтобы бороться за 10–20% годового прироста, вы начнёте мыслить категориями Х2, Х5, Х10, узнаете, как объединять компании и создавать новую ценность на рынке. - Начнёте мыслить как инвестор, а не как владелец.

Вы узнаете, как превратить свой бизнес из «дела всей жизни» в ценный актив, который можно растить, покупать и продавать, чтобы высвобожденная ментальная энергия направилась на создание долгосрочной стратегии. - Научитесь использовать свою системную компанию как ядро для кратного роста.

Вы не будете строить с нуля, а сможете быстро присоединять другие компании, применяя свой опыт в индустрии, который вы накопили, и получите возможность достигать роста в разы быстрее, чем конкуренты. - Начнёте строить не просто компанию, а наследие.

Ваша деятельность сможет обрести новый, глубокий смысл, и вы получите огромное удовлетворение от реализации своего потенциала на 100%, создавая что‑то, что способно оказывать влияние на рынок долгие годы. - Станете частью закрытого клуба, который может стать вашим главным активом.

Вы будете на равных общаться с лучшими и получите «чувство безопасности», зная, что в любой сложной ситуации у вас есть к кому обратиться за советом. Это окружение станет вашим источником энергии для прорывного роста.

Несколько раз в год Александр Высоцкий встречается с участниками оффлайн*

для живого общения и прокачки

Если вы хотите лично встретиться с Александром Высоцким и поработать над стратегией своего бизнеса в кругу крутых предпринимателей своего уровня -

оставляйте заявку, чтобы узнать подробности

о ближайшей встрече

*Участники x100 Strategy Mastermind оплачивают только оргвзнос, компенсирующий затраты на организацию мероприятия - зал, питание, расходные материалы и т.п.

Частые вопросы наших клиентов

-

Как привлекать финансирование, как получить инвестиции?

Мы планируем делать роллапы с использованием заемных средств.

Если вы эксперт в какой-то индустрии, это не означает, что вам обязательно надо в это инвестировать свой капитал. Роллап можно сделать с привлечением заемных средств и инвестиций.

Это наша часть работы поднять деньги, мы для этого и сделали private equity fund.

Если захотите свои деньги вложить, потенциально больше сможете заработать. Если не хотите, у вас нет денег или не хотите рисковать своими деньгами, то не проблема, потому что под это довольно легко привлечь инвестиции, и именно этим мы будем заниматься.

Как правильно искать компании для покупки, мы тоже научим и более того, будем оказывать помощь в этом. То есть мы не ожидаем, что эксперт, который участвует в роллапе, знает, как это делать. Здесь мы планируем оказывать большую помощь.

-

А мы точно потянем? На текущую команду нельзя положиться.

Экспертные знания и участие в мозговых штурмах важны. Работая с ролапами, вы приносите ценность, демонстрируя процесс и делясь опытом. Обсуждайте успехи, неудачи, возникающие вопросы и особенности. Ваши инсайты помогут выявить нюансы и возможности в вашей отрасли, так как каждая индустрия уникальна.

Анализ финансовой документации может выявить потенциальные риски или возможности для роста. Эти особенности могут быть специфичными для вашей отрасли или общими. Благодаря вашей экспертизе, вы вносите значительный вклад, зная свою нишу.

-

Как читать финансовую документацию компании перед покупкой?

Действительно, надо уметь читать цифры. Потому что, когда вы покупаете компанию, вам нужно сделать анализ финансовой отчетности. В нашей Rollup Academy есть отдельный модуль, посвященный финансам. Там будет много примеров. Также на еженедельных мозгоштурмах периодически мы будем разбирать живую финансовую отчетность, есть определенная технология, с которой вы разберетесь

-

Как объединять оргструктуры? Мы приобретаем компанию, а там клубок связанных обязанностей, не понятно, как это распутывать.

На Бизнес Бустере мы, безусловно, учим создавать структуру компаний. Это сложный и трудоемкий процесс. При покупке чужих компаний задача становится еще более сложной. Когда мы будем делать с вами ролап, это будет наша часть экспертизы - экспертизы по созданию структуры управляющей компании. Мы будем оказывать вам помощь, адаптировать и строить структуру приобретаемых компаний.

-

Интересует легальная сторона, налоги.

Да, мы собираемся об этом рассказывать, объяснять. Есть способы, как не переплачивать налоги, мы все это обязательно будем разбирать на программе. И, более того, под каждый ролап мы будем привлекать партнера юриста, либо нанимать компанию, которая будет собственно заниматься юридическими вопросами, в том числе налоговой оптимизацией

-

Надо ли этим именно сейчас заниматься?

Зависит от вашей цели. Процесс занимает несколько лет. Чем раньше начнете - тем раньше придете к цели. Сейчас хорошее время - с одной стороны продается много компаний, с другой стороны растет интерес к кеш-генерирующим компаниям, рынок капиталов ищет малорисковые доходные способы инвестиций

-

Сколько надо времени?

Цикл жизни ролапа займет 3 до 5 лет, в зависимости от того, с какой скоростью двигаемся. Но есть фаза подготовки к ролапу, это требует не так много времени, будет занимать не больше 10 часов в неделю

Следующая фаза, когда уже начинаем делать ролап в какой-то индустрии, потребуется минимум 20-30 часов неделю.

-

Как я буду полезен группе людей, которые будут заниматься ролапами?

Экспертиза в вашей отрасли, участие в мозгоштурмах играют большую роль. Когда вы занимаетесь ролапами, вы автоматически приносите ценность просто тем, что демонстрируете этот процесс и делитесь опытом. Вы можете поделиться тем, что у вас получается, что не удается, какие вопросы возникают, особенности процесса. Каждый из вас будет видеть свои нюансы и возможности в своей отрасли Их увидеть можете только вы, так как все индустрии уникальны и имеют свои специфики.

Даже на этапе анализа финансовой документации, можно увидеть потенциальные риски или, наоборот, возможности. Иногда эти особенности специфичны для определенной отрасли, иногда они общие. Просто благодаря вашей экспертизе в определенной области, вы будете вносить свой вклад, так как вы знаете свою нишу.

-

Реально ли выстраивать ролапы в моей сфере?

Формирование ролапов может быть невозможно в некоторых областях, но для индустрий, изучаемых в рамках программы «x100 Strategy», это абсолютно реализуемо. В этих сферах ролапы уже внедряются. Даже если встретятся непреодолимые трудности, всегда есть смежные индустрии. Пока мы не столкнулись с неразрешимыми проблемами, хотя теоретически они возможны. В ходе мастермайнда каждый случай будет рассматриваться индивидуально.

-

Я живу в Казахстане, Украине, не в США, подойдет ли мне?

Лучший рынок для ролапов — США. У нас есть резиденты из 57 стран, включая Европу, Центральную и Юго-Восточную Азию. Мы не делаем ролапы в санкционных странах. Возможна работа из других стран, например, из Казахстана, с необходимостью посещения США для погружения в процесс.